Healthcare Sector increasing the focus in Big Data and Technology

Have you heard about the IBM Watson Health’s layoffs? Well, if not, then the media buzz in the last week came forward with the reported layoffs from IBM Watson Health. The report from media buzz signifies the IBM Watson Health’s layoff as a ‘bloodbath’. In place of this, IBM Watson Health stepped in and confirmed about the layoffs at few of their businesses. Surprisingly, these businesses are those which the IBM Watson Health had acquired earlier. However, the IBM Watson Health refrained from revealing the no. of such acquired businesses which were struck by the layoffs. In place of this, the IBM Watson Health positively declares that it would continue to hire more of these businesses within other frontiers.

If you look back a couple of years, you will see that IBM Watson Healthcare had reached a long way. Today, it glorifies itself as a significant player within the frontiers of the healthcare space. Hence, the volatility of IBM Watson Healthcare still sounds a big surprise to most of us. Throughout its developing phase, IBM Watson Healthcare focused on the artificial intelligence capabilities. It concentrated on merging the artificial intelligence capabilities with the acquisitions. Simultaneously, it started generating partnerships with the significant data services within the frontiers of healthcare.

This year, in March, the IBM Watson Health announced its venture with the Mayo Clinic. IBM Watson Heath’s venture with the Mayo Clinic helped the firm to increase the number of patient enrolment. The IBM Watson Health entered into an experiment with the Mayo Clinic to match patients with the clinical trials. The subsequent increase in the patient enrolment was about eighty percent as seen in systemic therapy studies for the breast cancers. The project went on for more than about eleven months.

IBM Watson Health, in a press release, said, “Over eleven months of the project, the time needed to screen an individual patient for clinical trial matches also fell when compared to traditional manual methods.”

Here the role of technology business mergers and big data firms within the healthcare frontiers comes into play. The business mergers of technology, as well as the big data firms in the healthcare sector, highlights a trend viral within the clinical trial space. In place of this, the majority of the clinical research organizations (CRO’s) have undergone dramatic transformations within themselves. These transformations are intending to provide additional services by the clinical research organizations on both the fronts.

Such an affirmation comes mainly from the desk of about seven largest clinical research organizations. The annual revenue of these top seven clinical research organizations accounts for nearly one billion dollars per annum. To penetrate deeper into the revenue statistics, data has been retrieved from the Tufts Centre for the Study of Drug Development (CSDD). The CSDD data sheet highlights about seventy-two percent of transactions. Now, this is called a big deal. When analyzed cautiously, the CSDD data sheet includes the operations such as mergers, acquisitions, and strategic partnerships. The transactional data sheet retrieved was from the CRO upper-end space since the year 2015. These transactions were titled to be ‘non-traditional.’ The non-traditional deals are those buying and selling transactions that occur between acquiring or merging with the entities or firms. But the only criteria is that these entities are not other clinical research organizations. Also, they must not be in the state of acquisition by organizations across the frontiers of space.

Doug Peddicord claims the entire scenario as fierce and conveys, “Clinical Research Organizations are now aggressively “stacking vertically” to provide as many services as possible in an effort to stand out.” Doug Peddicord is the executive director at the ACRO. ACRO stands for Association of Clinical Research Organizations. ACRO is a conglomeration of the top clinical research organizations framed for regulating the functioning of CRO’s within their sphere of reach.

In addition to this, Neal McCarthy has got something to say. According to Neal McCarthy, “Many of these unusual acquisitions have been designed to take better advantage of Big Data. Among the potential benefits is squeezing value out of the data that is already being collected,” Neal McCarthy is the managing director of an investment banking firm Fairmount Partners. In addition to being a managing director, he is a close observer of the CRO space.

Peddicord agrees with Neal McCarthy’s statement. He says, “All those mountains of data, which previously were just mountains of data, now can be used.”

Some of the odd bedfellows currently operating in space are as follows:

LabCorp took over CRO Covance in the year 2015. LabCorp is one of the top lab companies. According to Ken Getz, the take-over of CRO Covance was a head scratcher for the entire CRO fraternity. Ken Getz is the founder as well as the Board Chair at CISCRP. CISCRP stands for Centre for Information and Study on Clinical Research Participation. In addition to being linked with the CISCRP, Ken is an associate professor and a director of Tuft CSDD’s sponsored programs. Ken says, “It baffled the market, but eventually it was realized that it’s a pretty shrewd move because it gives Covance access to a lot of de-identified patient data and the use of the blood monitoring services of LabCorp.”

On the other hand, the CRO Covance take over went well even for the LabCorp. As a result of the took over, the LabCorp is now able to reduce its reliance on government and other large insurance companies. Before this takeover, the LabCorp mostly relied on the government and larger insurance companies for funding their clinical trials. Also, the LabCorp is also working on the acquisition of giant customers for the additional funding. The funding from giant customers will facilitate the LabCorp with top dollar investment for speeding up their excellent services. This entire investment clarification was put forward by McCarthy.

The next in line was Quintiles. Quintiles is currently the most prominent clinical research organization in space. In the year 2016, Quintiles merged with IMS Holdings. IMS Holdings is a Market and Sales research company. This merging of Quintiles with the IMS Holdings was highlighted as the pairing of a robust clinical research organization one of the most exceptional commercialization companies. However, if you carefully observe, the Quintiles was eventually taken over by IMS Holdings rather than merging with it. The new entity that arose after this take over was renamed as IQVIA.

According to Peddicord, it was one of the most unusual combos of merging a large CRO with a commercialization company. Thinking of the entire world changed when the main reason for this merger came out. It was brought about to capture the real-world evidence. This real-world evidence was then used for driving the innovations and filling out the vertical stacks.

In addition to the above two examples of CRO takeovers, the CRO PPD acquired the CRA/Radiant and Synexus in the year 2015 and 2016 respectively. Also, the CRO ICON captured the PMG research group in the year 2015.

Similar acquisition strategies were formulated and worked out by other clinical research organizations about fifteen years ago. However, Peddicord believes that the efforts for buying the site groups were subsequently throttled down with time. For technology, Peddicord says, “Technology now has the potential to allow sites to be a part of the CRO business based not on people services, but on data services.”

In spite of all the ups and downs, the evolution of the clinical research organization space is permanent. The permanent status of CRO space reflects in the in the changes witnessed at the Association of Clinical Research Organizations. It is being highlighted that the ACRO has recently introduced alterations within their bylaws. The bylaw alterations apply to the clinical research conducting companies who conduct the study on behalf of their sponsors. Also, it is also applicable to those companies and organizations who vouch and support the clinical research conductance.

While the clinical research organizations are undergoing a considerable shuffling, naturally their customers have to come up with their reactions. Let us have a look at the responses of the CRO customers.

What are the reactions of the customers of Clinical Research Organization? Are the sponsors still favoring these expanded clinical research organizations with their colossal funding?

As time reveals everything, the time progresses everything about the sponsors and their favor to the CRO’s. The existing CRO sponsors are still analyzing the markets of these Clinical Research Organizations for the nascent CRO entries. However, it is clear that the adoption process will be comparatively slower than it was earlier. This slow process is parallel to the nature of the biopharma industries. It is the inbuilt conserved nature of the particular biopharma industries to think about adopting anything new.

Peddicord concludes, “Ultimately, drugs’ cost will be based on the value they create in the healthcare system, and to get to value pricing, you have to do value contracting between payers and pharmaceutical companies. To get to that, you have to do value-based development as well. I think there’s where the data revolution is a necessary condition because it’s the mountains of real-world evidence and outcomes data that will drive the value conversation between providers both of services and manufacturers of drugs, and the payers.”

It will be indeed interesting to wait and watch the role of significant CRO sponsors in context of adopting the expanded clinical research organizations. Let us hope that the whole shuffling within the frontiers of Clinical Research Organizations space proves beneficiary to humanity. May our best wishes always back these CRO’s in their future endeavors.

Find a course provider to learn Clinical Research

Java training | J2EE training | J2EE Jboss training | Apache JMeter trainingTake the next step towards your professional goals in Clinical Research

Don't hesitate to talk with our course advisor right now

Receive a call

Contact NowMake a call

+1-732-338-7323Enroll for the next batch

Clinical Research Training Course Program

- Dec 15 2025

- Online

Clinical Research

- Dec 16 2025

- Online

Clinical Research Training Course Program

- Dec 17 2025

- Online

Clinical Research Training Course Program

- Dec 18 2025

- Online

Clinical Research Training Course Program

- Dec 19 2025

- Online

Related blogs on Clinical Research to learn more

CDISC SDTM: Standardizing Clinical Data for Enhanced Research Insights

Learn the importance of CDISC SDTM standards in enhancing research insights by standardizing clinical data.

Exploring the Significance of Medical History in Healthcare

Discover the crucial role of medical history in healthcare, understanding how it informs diagnosis, treatment, and patient care, and its impact on the evolution of medicine.

Key Stages of a Typical Clinical Trial Process Flow

Clinical trials follow a well-defined process flow that is essential for conducting successful and ethical clinical research.

Understanding the Key Stages of a Typical Clinical Trial Process Flow

Discover the critical steps involved in each stage, ensuring a smooth and successful clinical trial process flow.

The Indispensable Role and Importance of Industry Regulations and Standards in Clinical Trials

we have discussed key function in clinical operations, clinical research organization, key function in data management and quality assurance.

Unveiling the Clinical Research Roadmap: A Comprehensive Guide

We have discussed the purpose of Clinical research processes, and what is clinical research process.

Corona Virus (COVID-19), Symptoms, Tests and Safety Measures

Corona Virus (COVID-19), Symptoms, Tests and Safety Measures. Learn the symptoms, tests to undergo, and safety measures to be taken to prevent the virus.

List of Best Clinical Research Training in Atlanta – CRC, CRA, MSCR Studies

We have collected a list of reputed institutes to those interested in pursuing a career in clinical and/or translational research. Pick from the list to have your dream come true career in medicine.

7 Ethics for Clinical Researchers

Clinical trials conducted by the researchers involve a human volunteer who is willing to be subject to adhere new findings or a medical experiment. For that, a proper consent is acquired from the volunteer before conducting the trials.

Will lowering Blood Pressure would save lives? Clinical Trials Says so…

So far, the healthcare industry had been advised that the blood pressure of a healthy adult has to be less than 140 millimeters of mercury. And any increase in blood pressure that this guideline would attract serious consequences such as heart attack

Latest blogs on technology to explore

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Explore the growing field of prompt engineering, a vital skill for AI enthusiasts. Learn how to craft optimized prompts for tools like ChatGPT and Gemini, and discover the career opportunities and skills needed to succeed in this fast-evolving indust

How Security Classification Guides Strengthen Data Protection in Modern Cybersecurity

A Security Classification Guide (SCG) defines data protection standards, ensuring sensitive information is handled securely across all levels. By outlining confidentiality, access controls, and declassification procedures, SCGs strengthen cybersecuri

Artificial Intelligence – A Growing Field of Study for Modern Learners

Artificial Intelligence is becoming a top study choice due to high job demand and future scope. This blog explains key subjects, career opportunities, and a simple AI study roadmap to help beginners start learning and build a strong career in the AI

Java in 2026: Why This ‘Old’ Language Is Still Your Golden Ticket to a Tech Career (And Where to Learn It!

Think Java is old news? Think again! 90% of Fortune 500 companies (yes, including Google, Amazon, and Netflix) run on Java (Oracle, 2025). From Android apps to banking systems, Java is the backbone of tech—and Sulekha IT Services is your fast track t

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Learn what prompt engineering is, why it matters, and how students and professionals can start mastering AI tools like ChatGPT, Gemini, and Copilot.

Cyber Security in 2025: The Golden Ticket to a Future-Proof Career

Cyber security jobs are growing 35% faster than any other tech field (U.S. Bureau of Labor Statistics, 2024)—and the average salary is $100,000+ per year! In a world where data breaches cost businesses $4.45 million on average (IBM, 2024), cyber secu

SAP SD in 2025: Your Ticket to a High-Flying IT Career

In the fast-paced world of IT and enterprise software, SAP SD (Sales and Distribution) is the secret sauce that keeps businesses running smoothly. Whether it’s managing customer orders, pricing, shipping, or billing, SAP SD is the backbone of sales o

SAP FICO in 2025: Salary, Jobs & How to Get Certified

AP FICO professionals earn $90,000–$130,000/year in the USA and Canada—and demand is skyrocketing! If you’re eyeing a future-proof IT career, SAP FICO (Financial Accounting & Controlling) is your golden ticket. But where do you start? Sulekha IT Serv

Train Like an AI Engineer: The Smartest Career Move You’ll Make This Year!

Why AI Engineering Is the Hottest Skillset Right Now From self-driving cars to chatbots that sound eerily human, Artificial Intelligence is no longer science fiction — it’s the backbone of modern tech. And guess what? Companies across the USA and Can

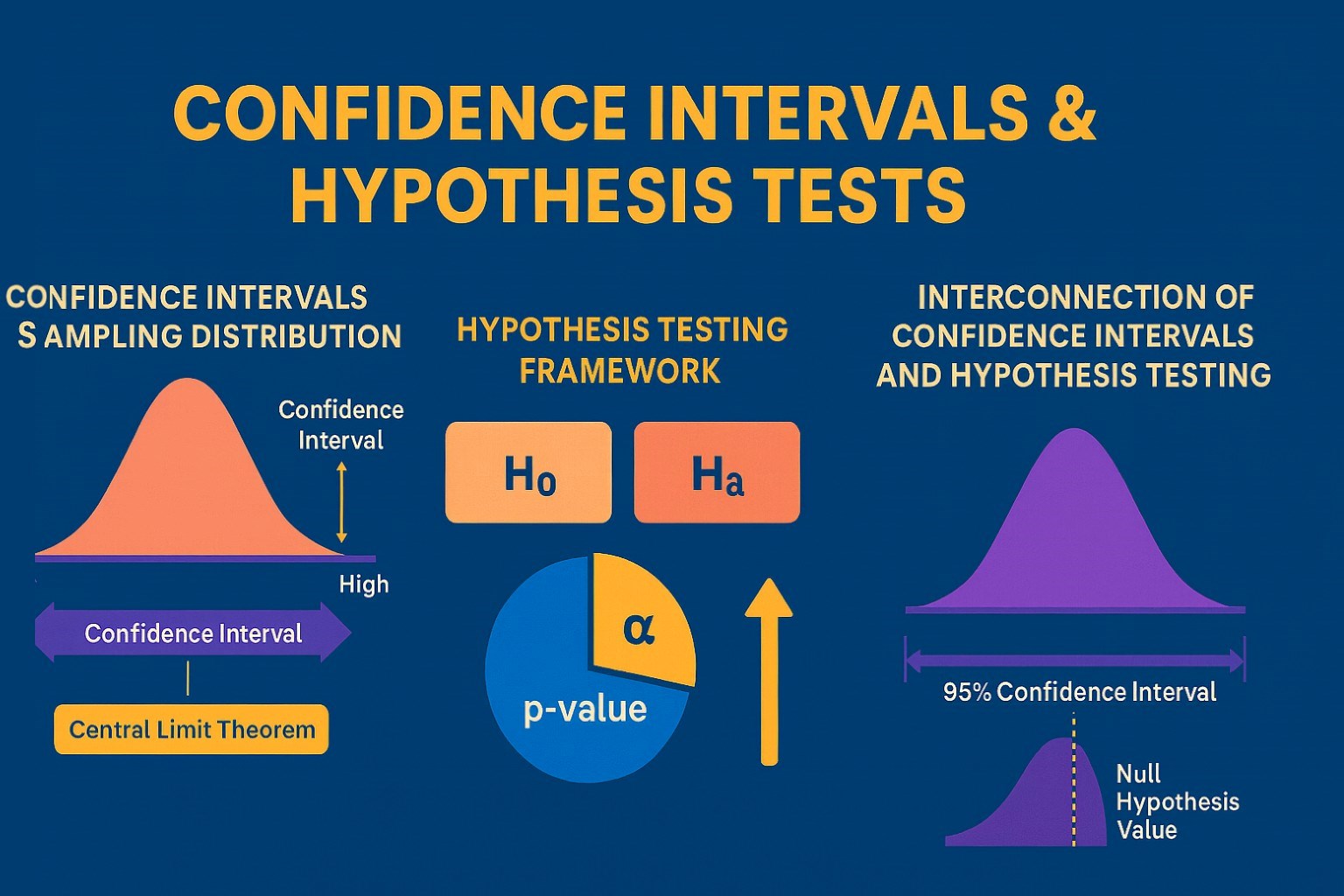

Confidence Intervals & Hypothesis Tests: The Data Science Path to Generalization

Learn how confidence intervals and hypothesis tests turn sample data into reliable population insights in data science. Understand CLT, p-values, and significance to generalize results, quantify uncertainty, and make evidence-based decisions.