In SAP FICO (Financial Accounting and Controlling), the term 'functional area' refers to a key organizational element allowing a more detailed classification of financial transactions and reporting. The functional area is a component of SAP's organizational structure and is primarily utilized in the Controlling (CO) module.

Definition:

The functional area in SAP FICO (Financial Accounting and Controlling) includes financial accounting, management accounting, financial reporting, asset accounting, cost controlling, and profit center accounting. These functional areas help organizations manage their financial processes, analyze financial data, and make informed business decisions.

Functional area in SAP FICO?

Functional areas include:

1. Financial Accounting (FI):

This functional area deals with the recording and managing of financial transactions such as accounts payable, accounts receivable, general ledger accounting, bank accounting, and asset accounting. It also includes features for managing financial closing processes, financial statements, and compliance with financial regulations.

2. Controlling (CO):

The Controlling module focuses on managerial accounting and provides tools for cost accounting, internal orders, profitability analysis, product costing, and budgeting. It enables organizations to monitor and analyze costs, revenues, and performance to support decision-making and strategic planning.

3. Asset Accounting:

This functional area within SAP FICO manages an organization's fixed assets, including asset acquisition, depreciation, retirement, and asset valuation. It helps organizations track and manage their physical and intangible assets efficiently.

4. Cost Controlling:

Cost Controlling is a key component of the Controlling module and involves controlling and monitoring costs within an organization. This includes cost center accounting, activity-based costing, and variance analysis to help manage and control costs effectively.

5. Profit Center Accounting:

This functional area allows organizations to analyze their profit and loss more granularly, such as by business segment or product line. It helps evaluate the profitability of different business areas and supports performance measurement and management.

Key Features and Usage:

1. Detailed Cost Allocation:

- Functional areas enable organizations to allocate costs to specific segments or departments with precision. This is crucial for internal reporting and analysis, allowing management to understand the cost structure of different areas.

2. Segmented Reporting:

- Financial reports can be generated based on functional areas, providing insights into the financial performance of individual units. This segmentation is valuable for managerial decision-making and performance evaluation.

3. Budgeting and Planning:

- Functional areas play a vital role in budgeting processes. Organizations can allocate budgets to specific functional areas, allowing for more accurate monitoring and control of expenditures within each area.

4. Profitability Analysis:

- By associating revenues and costs with functional areas, organizations can conduct profitability analysis at a granular level. This is particularly useful for identifying the business's most and least profitable segments.

5. Intercompany Transactions:

- In organizations with multiple subsidiaries or business units, functional areas help track intercompany transactions. This ensures that financial data is appropriately attributed to the relevant business unit.

Configuration and Implementation:

Creation of Functional Areas:

Functional areas are defined in the SAP system through configuration settings. Each functional area is assigned a unique identifier and a description that reflects its purpose within the organization.

Integration with Other SAP Modules:

Functional areas in SAP FICO are closely integrated with other SAP modules, such as SAP CO and SAP PS (Project System). This integration ensures consistency in financial data across different functional areas.

Authorization Control:

Access to specific functional areas can be controlled through authorization settings, ensuring users have the appropriate permissions to view or modify financial data within their designated areas.

In summary, functional areas in SAP FICO provide a structured framework for organizing and analyzing financial data, offering organizations a powerful tool for enhanced control, reporting, and decision-making. The utilization of functional areas aligns with the principle of granularity in financial management, allowing businesses to delve into the specifics of their financial operations.

Find a course provider to learn SAP FICO

Java training | J2EE training | J2EE Jboss training | Apache JMeter trainingTake the next step towards your professional goals in SAP FICO

Don't hesitate to talk with our course advisor right now

Receive a call

Contact NowMake a call

+1-732-338-7323Take our FREE Skill Assessment Test to discover your strengths and earn a certificate upon completion.

Enroll for the next batch

Related blogs on SAP FICO to learn more

SAP FICO in 2025: Salary, Jobs & How to Get Certified

AP FICO professionals earn $90,000–$130,000/year in the USA and Canada—and demand is skyrocketing! If you’re eyeing a future-proof IT career, SAP FICO (Financial Accounting & Controlling) is your golden ticket. But where do you start? Sulekha IT Serv

Exploring the Different Career Paths in SAP FICO: Which One is Right for You

As of this month's recent data, SAP FICO professionals in the job market have increased to 16, 40,000, and it is expected to grow based on the location and organization needs. This is a unique career path for many professionals intending to begin the

SAP FICO Integration with Other SAP Modules: Maximizing Your ERP System

SAP FICO Integration with Other SAP Modules: Maximizing Your ERP System

Crucial sub-modules within SAP FICO platform!

SAP FICO is one of the several modules in SAP, a leading relational database management system with artificial intelligence. The term FICO in SAP FICO stands for Financial Accounting (FI) and Controlling (CO).

Fancy a career in SAP FICO? Here is what you ought to know

SAP is the acronym for ‘System Application and Products’. It was found in the year 1972 by 5 IBM employees in Germany with the aim of assisting businesses in managing their operational processes.

Expertise on FICO among the top SAP Skills

There would no two opinions on the significance of SAP ERP. Several modules are available in SAP ERP where some of them hold tremendous potential from the career standpoint. A career in these SAP modules will not only offer you a professional growth

How SAP FICO influences the growth of a business?

The reason for SAP FICO being the most preferred financial software than many other platforms such as Oracle, BAAN etc. is that its compatibility and configuration features. SAP FICO is compatible with many systems and it does have exclusive configur

Top SAP Skill Sets Required For the Coming Years

According to the statistics reported by one of the prominent research firms, SAP skills have been ranked as one of the top 7 skills in IT in demand during 2015. That certainly makes SAP FICO a lucrative subject to pursue. So, it is very important to

Redefine the efficiency in enterprise accounting with SAP FICO!

Be it preparing reports and statements or generating financial forecasts, business and financial accounting are completely complicated processes. It consumes enormous time and resources too. But gone all the hard days where preparing financial statem

How to Make It Big As A SAP FICO Consultant

SAP FICO is an important module of the ERP (Enterprise Resource Planning, which isbusiness management software for integrated applications) and both FI and CO modules store financial transactions data. The

Latest blogs on technology to explore

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Explore the growing field of prompt engineering, a vital skill for AI enthusiasts. Learn how to craft optimized prompts for tools like ChatGPT and Gemini, and discover the career opportunities and skills needed to succeed in this fast-evolving indust

How Security Classification Guides Strengthen Data Protection in Modern Cybersecurity

A Security Classification Guide (SCG) defines data protection standards, ensuring sensitive information is handled securely across all levels. By outlining confidentiality, access controls, and declassification procedures, SCGs strengthen cybersecuri

Artificial Intelligence – A Growing Field of Study for Modern Learners

Artificial Intelligence is becoming a top study choice due to high job demand and future scope. This blog explains key subjects, career opportunities, and a simple AI study roadmap to help beginners start learning and build a strong career in the AI

Java in 2026: Why This ‘Old’ Language Is Still Your Golden Ticket to a Tech Career (And Where to Learn It!

Think Java is old news? Think again! 90% of Fortune 500 companies (yes, including Google, Amazon, and Netflix) run on Java (Oracle, 2025). From Android apps to banking systems, Java is the backbone of tech—and Sulekha IT Services is your fast track t

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Learn what prompt engineering is, why it matters, and how students and professionals can start mastering AI tools like ChatGPT, Gemini, and Copilot.

Cyber Security in 2025: The Golden Ticket to a Future-Proof Career

Cyber security jobs are growing 35% faster than any other tech field (U.S. Bureau of Labor Statistics, 2024)—and the average salary is $100,000+ per year! In a world where data breaches cost businesses $4.45 million on average (IBM, 2024), cyber secu

SAP SD in 2025: Your Ticket to a High-Flying IT Career

In the fast-paced world of IT and enterprise software, SAP SD (Sales and Distribution) is the secret sauce that keeps businesses running smoothly. Whether it’s managing customer orders, pricing, shipping, or billing, SAP SD is the backbone of sales o

SAP FICO in 2025: Salary, Jobs & How to Get Certified

AP FICO professionals earn $90,000–$130,000/year in the USA and Canada—and demand is skyrocketing! If you’re eyeing a future-proof IT career, SAP FICO (Financial Accounting & Controlling) is your golden ticket. But where do you start? Sulekha IT Serv

Train Like an AI Engineer: The Smartest Career Move You’ll Make This Year!

Why AI Engineering Is the Hottest Skillset Right Now From self-driving cars to chatbots that sound eerily human, Artificial Intelligence is no longer science fiction — it’s the backbone of modern tech. And guess what? Companies across the USA and Can

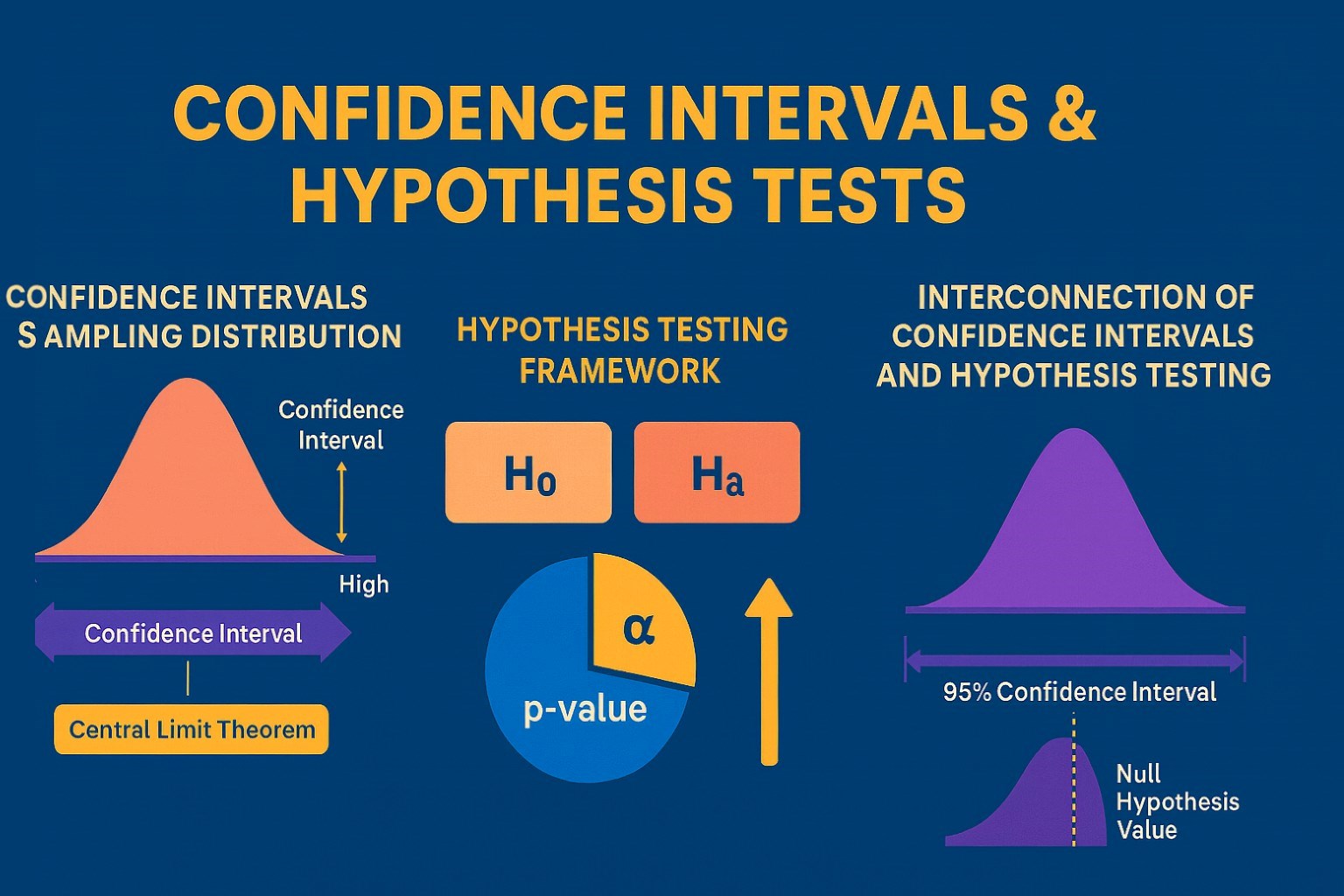

Confidence Intervals & Hypothesis Tests: The Data Science Path to Generalization

Learn how confidence intervals and hypothesis tests turn sample data into reliable population insights in data science. Understand CLT, p-values, and significance to generalize results, quantify uncertainty, and make evidence-based decisions.