Many financial service firms invest heavily in the governance, regulatory compliance, risk management, as well as customer data through their service lines, subsidiaries lines and product lines, which are on-going requirements. In case of banks, it is crucial to juggle risk management with smart intelligence that is required for growth and success. Many financial institutions offer services for their customers without any profit, like in banks, the free checking for high-activity customers with low balances.

In most of the cases the bank’s profit comes from only the 20%-30% profitable customers and the majority of them do not contribute to the profit of the bank. Many financial institutions make use of BI to identify those unprofitable customers and look for opportunities to enhance relationships and convert them to profitable customers.

Investing in a career as a SAP BI developer or consultant is certainly lucrative and you could begin with the SAP BI certification courses.

Below are listed some tips for the application of BI (business intelligence) in financial services.

Pull Instead Of Push Strategy:

The strategy of pull works better than push. Pushing products on customers is not a very good idea. Instead an organization needs to reorient itself to pull customers through robust analytics and greater use of business intelligence.

Identify Features for Flexibility:

Instead of employing the push strategy, business intelligence should identify the services or features that can be incorporated to generate more business without compromising on the profit. Nowadays customers want to dictate the features of the products and want the products to be customized according to their needs and they are willing to shell out extra money for that.

Understanding Data:

In financial services, customer data is of vital importance while designing a product. The requirement of the customer is the foremost in the creation of products and you have to understand that. All the sophisticated equipment’s and methods you employ, would do you no good if you fail to understand the requirements of your customers.

Get Centralized Data Governance:

The governance of data should be made centralized. Although it is difficult to integrate the divergent business systems and data stores into centralized data warehouse, the financial services can still benefit from the stewardship of centralized data. This should be adopted, otherwise there would be lack of compliance and standards and a divergent information management tactics leading to the failure to achieve the top-notch initiatives that are dependent on the product, customer and financial data quality.

To Remember That BI is a Business Problem:

Themost common mistake is to assume that the BI is a technology problem. It is rather a performance management, governance, processes and organizational structural problem. It should always be kept in mind that IT cannot dish out an effective business intelligent system on its own.

Specific Tools Are Less Important:

Less importance should be attached to the tools as the vendors believe that a BI application is not dependent on a particular tool and the predictive analysis of the BI application is dependent on the algorithms, business rules and transformation of data rather on the tool.

Combining Education With Information Acquired In An Iterative Process.

In order to streamline the customer profitability calculation and put it into effect, a draft methodology should be developed to calculate the profitability and compute examples employing existing customers. The draft should be then applied to a small group in the organization and feedbacks should be incorporated and the revisions should be made quickly. To apply this to a broader segment, your staff should be educated to define profitability and its method of computation. The next step should be to train your employees so that they are able to take more profitable customer decisions and solicit feedback to enhance the method of calculation and usage.

The deployment of BI in the financial industry is on the rise and you could make a profitable career as a SAP BI consultant with SAP BI training.

Find a course provider to learn SAP BI

Java training | J2EE training | J2EE Jboss training | Apache JMeter trainingTake the next step towards your professional goals in SAP BI

Don't hesitate to talk with our course advisor right now

Receive a call

Contact NowMake a call

+1-732-338-7323Enroll for the next batch

SAP BI Certification Course

- Dec 12 2025

- Online

Related blogs on SAP BI to learn more

What is the difference between SAP CRM and SAP BI platform?

No expert in this entire globe can be 100% sure about choosing the right software product. The reason is that every second or so, a software scientist develops a new software. However, the industry expert can determine the appropriate software platfo

SAP BI pushed the Enterprise business intelligence to great heights!

All these components of SAP BusinessObjects Business Intelligence are known for its platform independent portable features and many other capabilities. The simplification of data manipulation, user's access to the enterprise data, effective enterpris

SAP BI in today’s world of business intelligence

The era of business intelligence sweeps every businesses and organization across the world. And the evolution of various business intelligence platforms eased the incorporation of artificial intelligence and strategic approaches in various types of b

Best Self-Service BI Tool Basics

The increasing complexity on decision making and the alarming necessity for a business intelligence tool led to the evolution of various Business Intelligent platforms. This blog walks through the necessity of BI tool and the selecting the best Self-

SAP BI Trends to benefit your business

The pioneer of enterprise software industry, SAP was revolutionizing the business industry with its rapidly beneficial ‘SAP BI Business Intelligence Platform”.

Stand Out In the Crowd of SAP BI Professionals with These Amazing Survival Tips

If you work in the huge IT industry, SAP or SAP BI would not be something new for you. However, like many other technologies, SAP BI has also undergone a lot of change in the past couple of decades. Given the changes that have been so rampant in the

Upcoming features in SAP BI Platform Support Tool 2.0

The inclusion of SAP BI Platform support tool is a boon to improvise the performance and characteristics built within

The Secret Behind Business Intelligence (BI) Success

Organizations understand the importance of business intelligence (BI) to support the effective operation of a company. Getting the right data at the right time to the right person are the prerequisites for the success of a business. Establishing the

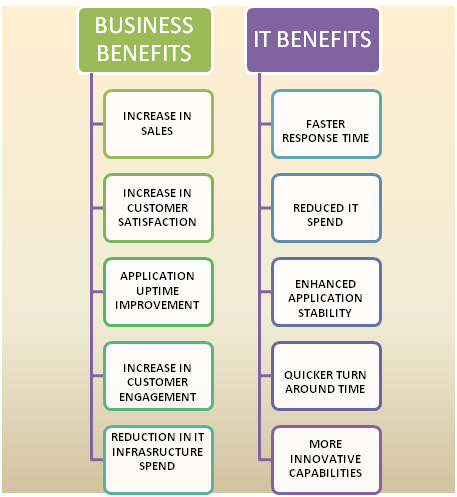

How SAP BI (Business Intelligence) helps the business?

SAP BI (Business Intelligence) is an excellent platform to accomplish those strategies. It enables to implement them with the help of exclusive suite of tools and applications to support the enterprises. In order to speed-up the growth, optimize the

How To Get User Friendly Data Representation With SAP BI Architecture

Business Intelligence is basically a SAP product and it focuses on data representation in a user friendly manner. This serves the purpose of analysis as well as taking business decision in an informed manner in business. It is therefore necessary to

Latest blogs on technology to explore

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Explore the growing field of prompt engineering, a vital skill for AI enthusiasts. Learn how to craft optimized prompts for tools like ChatGPT and Gemini, and discover the career opportunities and skills needed to succeed in this fast-evolving indust

How Security Classification Guides Strengthen Data Protection in Modern Cybersecurity

A Security Classification Guide (SCG) defines data protection standards, ensuring sensitive information is handled securely across all levels. By outlining confidentiality, access controls, and declassification procedures, SCGs strengthen cybersecuri

Artificial Intelligence – A Growing Field of Study for Modern Learners

Artificial Intelligence is becoming a top study choice due to high job demand and future scope. This blog explains key subjects, career opportunities, and a simple AI study roadmap to help beginners start learning and build a strong career in the AI

Java in 2026: Why This ‘Old’ Language Is Still Your Golden Ticket to a Tech Career (And Where to Learn It!

Think Java is old news? Think again! 90% of Fortune 500 companies (yes, including Google, Amazon, and Netflix) run on Java (Oracle, 2025). From Android apps to banking systems, Java is the backbone of tech—and Sulekha IT Services is your fast track t

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Learn what prompt engineering is, why it matters, and how students and professionals can start mastering AI tools like ChatGPT, Gemini, and Copilot.

Cyber Security in 2025: The Golden Ticket to a Future-Proof Career

Cyber security jobs are growing 35% faster than any other tech field (U.S. Bureau of Labor Statistics, 2024)—and the average salary is $100,000+ per year! In a world where data breaches cost businesses $4.45 million on average (IBM, 2024), cyber secu

SAP SD in 2025: Your Ticket to a High-Flying IT Career

In the fast-paced world of IT and enterprise software, SAP SD (Sales and Distribution) is the secret sauce that keeps businesses running smoothly. Whether it’s managing customer orders, pricing, shipping, or billing, SAP SD is the backbone of sales o

SAP FICO in 2025: Salary, Jobs & How to Get Certified

AP FICO professionals earn $90,000–$130,000/year in the USA and Canada—and demand is skyrocketing! If you’re eyeing a future-proof IT career, SAP FICO (Financial Accounting & Controlling) is your golden ticket. But where do you start? Sulekha IT Serv

Train Like an AI Engineer: The Smartest Career Move You’ll Make This Year!

Why AI Engineering Is the Hottest Skillset Right Now From self-driving cars to chatbots that sound eerily human, Artificial Intelligence is no longer science fiction — it’s the backbone of modern tech. And guess what? Companies across the USA and Can

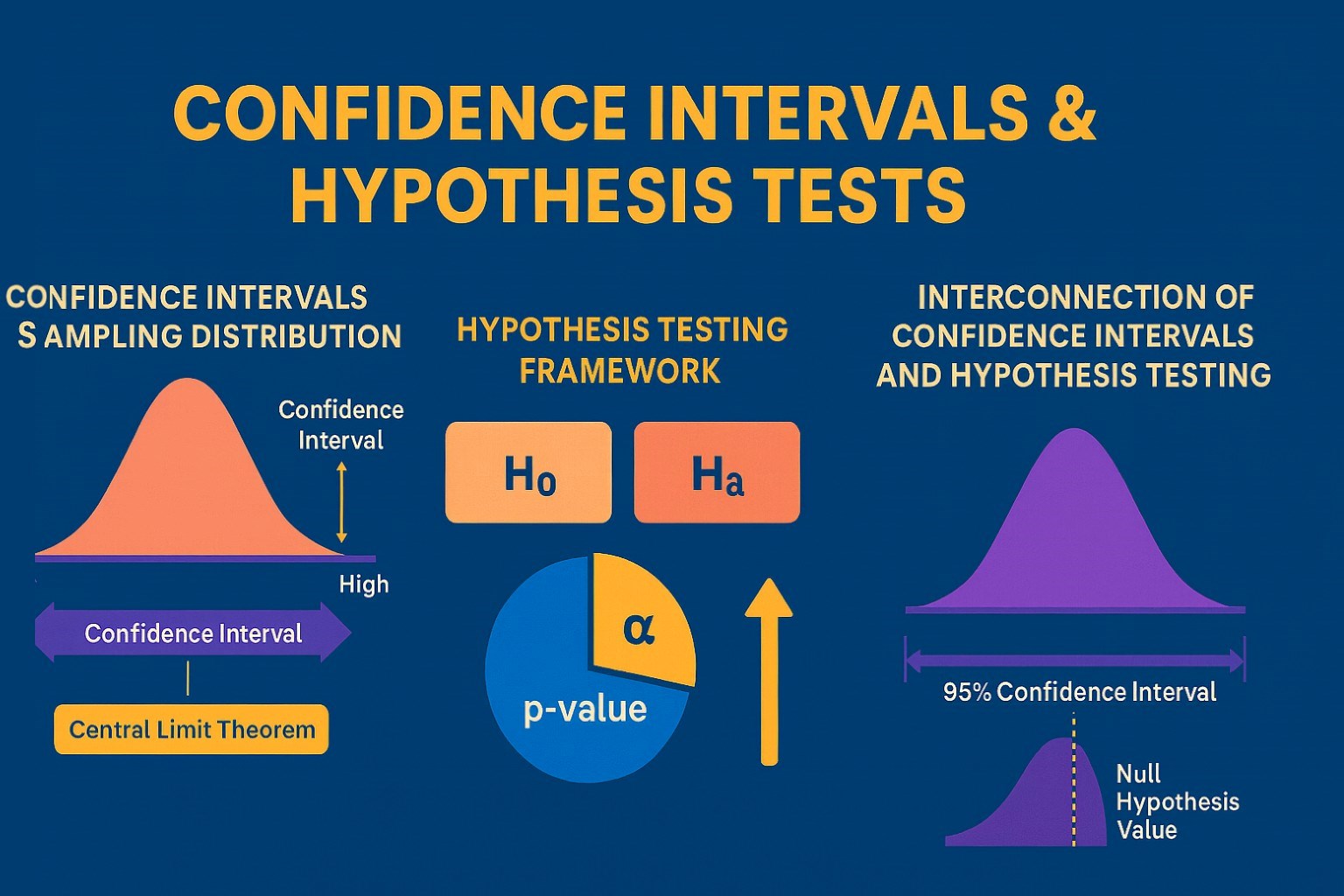

Confidence Intervals & Hypothesis Tests: The Data Science Path to Generalization

Learn how confidence intervals and hypothesis tests turn sample data into reliable population insights in data science. Understand CLT, p-values, and significance to generalize results, quantify uncertainty, and make evidence-based decisions.