SAP FICO Configuration: Setting Up Your Financial Accounting System

SAP FICO Configuration: Setting Up Your Financial Accounting System

Introduction

SAP FICO Configuration is a critical part of setting up your Financial Accounting System. By properly configuring SAP FICO, you can streamline financial processes and improve data accuracy. This guide will show you how to properly configure SAP FICO for your business. Financial accounting system is important for business entities to manage and report their financial information. This system is important in providing accurate and timely financial information to users, which helps them in making informed decisions.

Some of the benefits of financial accounting system are:

1. Maintaining financial records: Financial accounting system helps businesses in maintaining accurate financial records. This system keeps track of all the financial transactions of the business and helps in preparing financial statements.

2. Analyzing financial performance: Financial accounting system can be used to analyze financial performance of the business. This system provides information on cash flow, profitability, and other important metrics.

3. Identifying trends and patterns: Financial accounting system can help businesses in detecting trends and patterns in their financial data. This information is helpful in making informed decisions about the future course of the business.

4. Compliance with regulations: Financial accounting system is essential for businesses that are required to comply with various regulations. This system helps in tracking financial transactions and providing accurate information to regulators.

5. Provides transparency of financial affairs: Financial accounting system allows users to access detailed information about the finances of the business. This information is helpful in making informed decisions about the future course of the business.

Financial accounting system is an important tool for businesses, and it plays a crucial role in helping them manage their finances and conduct business operations efficiently. The benefits of using a financial accounting system are manifold, and businesses should consider using one if they want to improve their financial performance and compliance with regulations. If you are looking for a reliable financial accounting system, our team at Accounting Web is here to help. We offer a wide range of affordable solutions that will meet your needs.

SAP FICO Configuration Overview

SAP FICO Configuration is the process of setting up the Financial Accounting System in SAP. The Financial Accounting System is used to manage financial data and transactions. SAP FICO Configuration includes configuring your financial data sources, configuring your financial accounting modules, and configuring your FICO score. There are a number of reasons why it is important to set up your financial accounting system. Perhaps the most important reason is that it provides you with information that you can use to make informed decisions about your business. This information can help you track your income and expenses, monitor your cash flow, and make decisions about pricing, inventory, and other aspects of your business.

Another reason to set up a financial accounting system is that it can help you comply with government regulations. In many cases , the government requires businesses to report their financial information in a specific format. If your business doesn't have a financial accounting system in place, you may not be able to comply with these regulations.

Configuring Your Financial Data Sources

The first step in SAP FICO Configuration is configuring your financial data sources. You need to configure the data sources that will provide accurate financial information for your business. You can use various types of data sources to generate financial information, such as accounting systems, banking systems, and reporting tools. Select the appropriate data source for your business and configure the necessary settings.

There are a few ways to configure your financial data sources. One way is to use a financial data service, such as Quicken or Mint, which can automatically download and update your financial data. Another way is to manually enter your financial data into a spreadsheet or other financial software. This method requires more work, but gives you more control over your data.

You can also get financial data from your bank or other financial institution. This data may be in the form of an Excel or CSV file. You can then open this file in a financial software program, such as Excel or Quicken, to view your data.

Configuring Your Financial Accounting Modules

- Once you have configured your financial data sources, you need to configure your financial accounting modules. Financial accounting modules are used to manage financial transactions and data. These modules include such features as accounts receivable, accounts payable, and payroll. Configure the appropriate modules for your business and configure the necessary settings. There are a number of financial accounting modules that you can configure to manage your finances. The most common modules are Accounts Receivable, Accounts Payable, Inventory, and General Ledger. Each module has its own unique set of features and options that you can use to tailor the module to your specific needs. In this article, we will discuss how to configure your financial accounting modules.

- The first step in configuring your financial accounting modules is to decide which modules you need. If you only have a few accounts receivable transactions, you can configure Accounts Receivable as your module. However, if you have a lot of transactions, you may want to configure Accounts Payable instead.

- After you decide which module to use, the next step is to determine which features and options you need. Each module has its own set of features and options that you can use to customize the way the module works.

For example, in Accounts Receivable, you can configure the following features and options:

- The amount of time that the module holds transactions in limbo before processing them.

- How long the module waits for payment from your customers.

- The frequency with which you send invoices to your customers.

- The number of days that the module keeps a customer's account open after they have not paid their bill.

- You can also configure Accounts Receivable to use different currencies, calculate taxes, and more.

Configuring Your FICO Score

Finally, you need to configure your FICO score. Your FICO score is used to determine your creditworthiness. Configure the necessary settings for your FICO score and ensure that it is accurate for your business.

SAP FICO Configuration is an important process for managing financial data and transactions in your business. This guide will show you how to properly configure SAP FICO for your business. Follow these steps to get started:

1. Select the appropriate data source for your business. You need to select a reliable financial data source that will provide accurate information for your business.

2. Configure the necessary financial accounting modules for your business. These modules include such features as accounts receivable, accounts payable, and payroll.

3. Configure your FICO score according to your business needs. Your FICO score is used to determine your creditworthiness. Ensure that the score is accurate for your business needs.

4. Monitor and maintain the accuracy of your financial data sources and accounting modules throughout the years to ensure proper performance of your business.

There are some other tips on how to configure your FICO score may include monitoring your credit report for accuracy, paying your bills on time, and keeping your credit utilization low. Additionally, you may also want to consider signing up for a credit monitoring service to help you keep track of your credit score and report any changes. Ultimately, the best way to configure your FICO score depends on your individual situation and goals.

Benefits of integrating SAP FICO with your Accounting System

There are many benefits of integrating SAP FICO with your accounting system. Some of the benefits include:

1. Increased accuracy and efficiency in financial reporting: By integrating SAP FICO with your accounting system, you can automate many of the tasks involved in financial reporting, such as data entry, calculation, and consolidation. This can help to improve the accuracy of your financial reports and reduce the amount of time needed to generate them.

2. Improved decision-making: With integrated financial reporting, you can more easily identify and track changes in your business performance. This can help to improve decision-making by identifying areas of improvement and directing resources where they are most needed.

3. Enhanced security: By integrating SAP FICO with your accounting system, you can protect your confidential financial data from unauthorized access. This can help to maintain the integrity of your company's financial records and protect against potential fraud or other criminal activity.

4. Improved compliance management: By integrating SAP FICO with your accounting system, you can ensure that your company is compliant with all applicable financial regulations. This can help to improve your company's reputation and protect its assets from potential liability.

5. Increased productivity: By automating many of the tasks involved in financial reporting, integrated SAP FICO can help to increase your company's productivity levels. This can help to reduce the amount of time needed to manage your finances and focus on more productive pursuits.

Conclusion

SAP FICO is a powerful tool that can help organizations streamline their financial and accounting processes. By integrating SAP FICO with your accounting system, you can take advantage of its many features and benefits, including its ability to automate financial and accounting tasks, its reporting capabilities, and its ability to improve data accuracy and efficiency. By integrating SAP FICO into your accounting system, you can improve your organization's financial and accounting operations, and make them more efficient and effective.

Take the next step towards your professional goals in SAP Financial Supply Chain Management

Don't hesitate to talk with our course advisor right now

Receive a call

Contact NowMake a call

+1-732-338-7323Latest blogs on technology to explore

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Explore the growing field of prompt engineering, a vital skill for AI enthusiasts. Learn how to craft optimized prompts for tools like ChatGPT and Gemini, and discover the career opportunities and skills needed to succeed in this fast-evolving indust

How Security Classification Guides Strengthen Data Protection in Modern Cybersecurity

A Security Classification Guide (SCG) defines data protection standards, ensuring sensitive information is handled securely across all levels. By outlining confidentiality, access controls, and declassification procedures, SCGs strengthen cybersecuri

Artificial Intelligence – A Growing Field of Study for Modern Learners

Artificial Intelligence is becoming a top study choice due to high job demand and future scope. This blog explains key subjects, career opportunities, and a simple AI study roadmap to help beginners start learning and build a strong career in the AI

Java in 2026: Why This ‘Old’ Language Is Still Your Golden Ticket to a Tech Career (And Where to Learn It!

Think Java is old news? Think again! 90% of Fortune 500 companies (yes, including Google, Amazon, and Netflix) run on Java (Oracle, 2025). From Android apps to banking systems, Java is the backbone of tech—and Sulekha IT Services is your fast track t

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Learn what prompt engineering is, why it matters, and how students and professionals can start mastering AI tools like ChatGPT, Gemini, and Copilot.

Cyber Security in 2025: The Golden Ticket to a Future-Proof Career

Cyber security jobs are growing 35% faster than any other tech field (U.S. Bureau of Labor Statistics, 2024)—and the average salary is $100,000+ per year! In a world where data breaches cost businesses $4.45 million on average (IBM, 2024), cyber secu

SAP SD in 2025: Your Ticket to a High-Flying IT Career

In the fast-paced world of IT and enterprise software, SAP SD (Sales and Distribution) is the secret sauce that keeps businesses running smoothly. Whether it’s managing customer orders, pricing, shipping, or billing, SAP SD is the backbone of sales o

SAP FICO in 2025: Salary, Jobs & How to Get Certified

AP FICO professionals earn $90,000–$130,000/year in the USA and Canada—and demand is skyrocketing! If you’re eyeing a future-proof IT career, SAP FICO (Financial Accounting & Controlling) is your golden ticket. But where do you start? Sulekha IT Serv

Train Like an AI Engineer: The Smartest Career Move You’ll Make This Year!

Why AI Engineering Is the Hottest Skillset Right Now From self-driving cars to chatbots that sound eerily human, Artificial Intelligence is no longer science fiction — it’s the backbone of modern tech. And guess what? Companies across the USA and Can

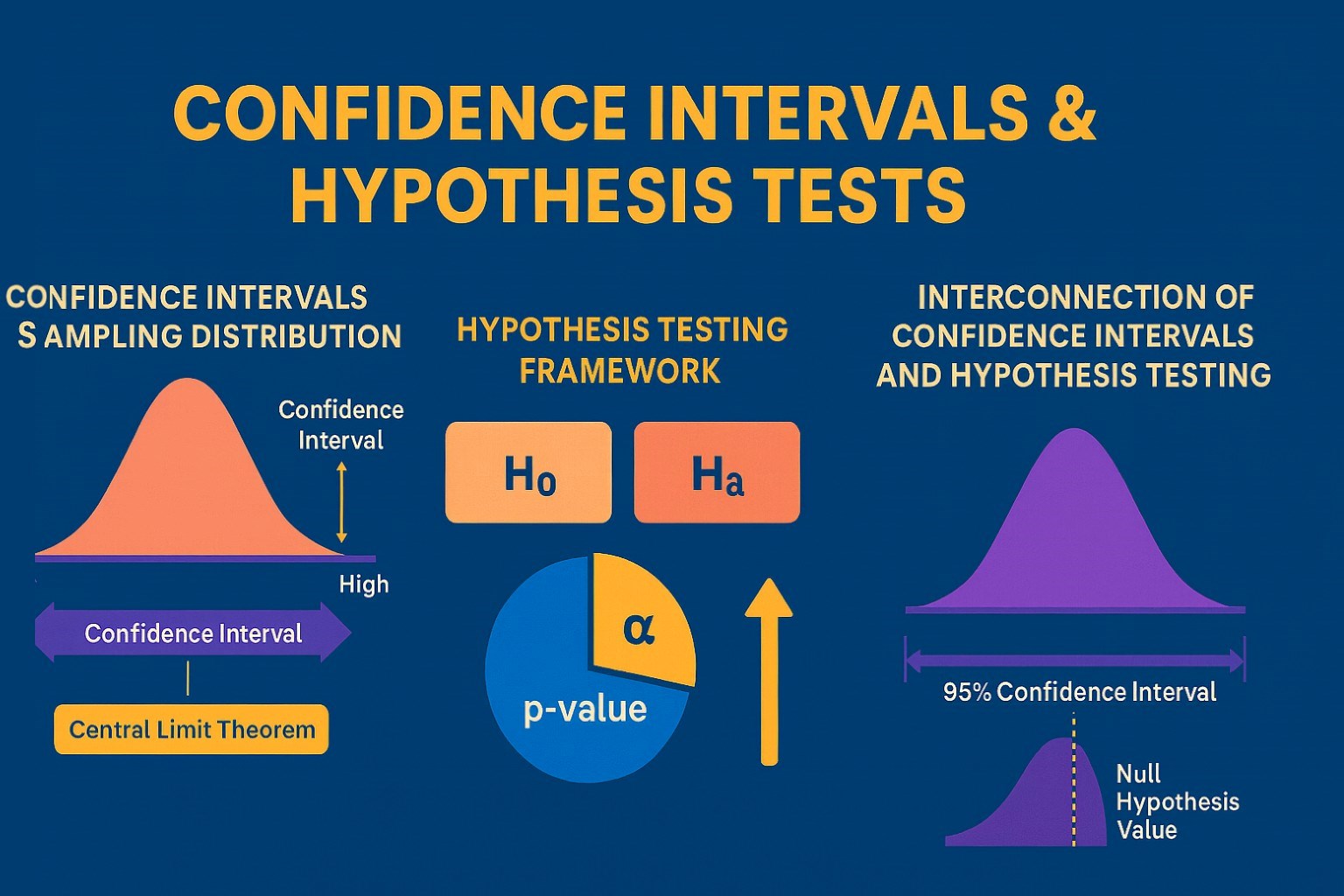

Confidence Intervals & Hypothesis Tests: The Data Science Path to Generalization

Learn how confidence intervals and hypothesis tests turn sample data into reliable population insights in data science. Understand CLT, p-values, and significance to generalize results, quantify uncertainty, and make evidence-based decisions.