Robotic Process Automation in Finance Market Analysis, 2031

Automation has surged in demand due to its transformative impact on industries and businesses across the globe. Automation offers a powerful solution in an era marked by digitalization and efficiency. It enables organizations to streamline operations, enhance productivity, and reduce costs significantly.

By automating repetitive and labour-intensive tasks, companies can reallocate human resources to more strategic and creative endeavors, driving innovation and growth. Additionally, automation brings consistency and precision that is hard to achieve manually, ensuring high-quality outcomes and reducing errors.

In a highly competitive and rapidly changing landscape, businesses increasingly turn to automation to gain a competitive edge, respond agilely to market shifts, and meet evolving customer expectations.

As a result, the demand for automation solutions and skilled professionals continues to grow, making it an indispensable force in today"s business world.

Robotic Process Automation in Finance Market:

The "Robotic Process Automation in Finance Market" is a booming sector with a higher market demand than other technologies. Notably, the RPA market peaked internationally in the financial industry from 2023 to 2031. Among the competitors like WorkFusion, Automation Anywhere, Thoughtonomy, Blue Prism, and UiPath, RPA has expanded fast and is a crucial player in the market- The Robotic Process Automation in Finance market research report and industry analysis.

Global Market of Robotic Process Automation in Finance market:

Global Robotic Process Automation in Finance market has grown from USD million to USD million from 2017 to 2022. The CAGR of this market is estimated to reach USD million in 2029.

Major Applications of RPA in Finance covered are:

Asset Management

- Fund and Security Services

- Retail and Lending Management

- Trading and Financial Management

- Insurance, Others

By Type:

- Software and Services

By Geography:

- Asia-Pacific

- North America

- Europe

- South America

- Middle-East and Africa

By Operations

- Rule Based

- Knowledge-Based

By Deployment

- Cloud

- On-Premise

By Enterprise Size:

- SMEs

- Large Enterprises

Key players operating in the RPA in the Finance market and its competition in 2023?

- Automation Anywhere

- Thoughtonomy

- Blue Prism

- UiPath

The study also includes a market analysis that employs a variety of analytical approaches, such as Porter"s Five Forces Analysis and PESTEL Analysis. These tools detail the micro- and macro-environmental factors influencing market growth during the predicted period.

Opportunities for Robotic Process Automation in the Financial Sector:

The Global Robotic Process Automation in Finance market is expected to increase within the forecast duration between 2023 and 2031. The market is anticipated to increase throughout the predicted horizon in 2023 due to key players" increasing adoption of tactics.

This most recent analysis indicates that there will be a significant shift from past years in the development of Third-Party Replacement Straps for Robotic Process Automation in Finance in 2023.

The Robotic Process Automation in Finance market has grown from USD million to USD million from 2017 to 2022. With a CAGR, this market is estimated to reach USD million in 2029.

The key topics of the report on robotic process automation in finance are the market size, segment size (primarily by product type, application, and geography), competitive environment, present scenario, and development trends. The research also offers business methods to help them deal with COVID-19 hazards.

Technological invention and improvement will downstream market applications. Additionally, research on consumer preferences, market dynamics (drivers, restrictions, and opportunities), new product introductions, the influence of COVID-19, and regional disputes allows us to understand the Robotic Process Automation in the Finance market completely.

According to a report, the growth of robotic process automation in the finance sector over the coming years will be primarily driven by several factors, including the rise in research and development spending on therapeutic vaccines. In addition, increased disease diagnostic techniques and growing research on combination medicines will result in significant market demand.

Robotic Process Automation Market Trends, Drivers, Restraints and Opportunities

- The trend towards hyper-automation involves the integration of RPA with other advanced technologies like artificial intelligence (AI), machine learning, and natural language processing (NLP) to automate routine tasks and complex decision-making processes.

- Organizations increasingly adopt cloud-based RPA solutions for scalability, flexibility, and cost-efficiency. Cloud RPA allows for easier remote access and management of automation processes.

- RPA helps organizations reduce operational costs by automating repetitive, rule-based tasks that would otherwise require manual labor.

- As automation involves handling sensitive data and processes, security is a significant concern. Organizations must ensure that RPA solutions are secure and compliant with data protection regulations.

- There are opportunities for RPA providers to develop industry-specific solutions tailored to the unique needs of sectors like healthcare, finance, and manufacturing.

Scope of the Robotic Process Automation Market Report:

The scope of a Robotic Process Automation (RPA) market report typically includes a comprehensive analysis of various aspects related to the RPA industry. Here are the key components that may be covered within the scope of such a report:

- Market Size and Growth: The report assesses the current market size and growth trends in the RPA industry. This includes historical data, current market value, and projections for future growth.

- Market Segmentation: RPA market reports often segment the market by technology type (e.g., rule-based RPA, cognitive RPA), by application (e.g., finance, healthcare, manufacturing), by deployment (e.g., on-premises, cloud-based), and by region.

- Market Drivers and Restraints: An analysis of the factors driving the growth of the RPA market, such as cost reduction, enhanced productivity, and regulatory compliance, as well as the challenges or restraints the industry faces.

- Technology Trends: Coverage emerging trends in RPA technology, such as hyper-automation, cloud-based RPA, and integration with artificial intelligence (AI) and machine learning.

- Regional Analysis: A breakdown of the RPA market by geographic region, including regional market size, growth trends, and market drivers unique to each region.

- Case Studies: Real-world case studies showcasing successful RPA implementations and their impact on organizations.

- Future Outlook: Projections and forecasts for the RPA market"s growth and evolution, including predictions regarding technology advancements and industry trends.

- Market Strategies: An exploration of the strategies adopted by RPA vendors to gain a competitive edge, including product development, partnerships, and market expansion.

- Emerging Markets: Evaluation of RPA adoption and growth opportunities in emerging markets.

The scope of an RPA market report aims to provide a comprehensive understanding of the industry.

In conclusion, Robotic Process Automation will be a game-changer in the finance industry by 2031. As financial institutions adapt to this digital transformation, they will harness the power of RPA to streamline operations, enhance customer experiences, and navigate the ever-evolving regulatory landscape. Understanding the market dynamics, challenges, and opportunities will be essential for organizations seeking a competitive edge in the finance sector of the future.

Find a course provider to learn Robotic Process Automation (RPA)

Java training | J2EE training | J2EE Jboss training | Apache JMeter trainingTake the next step towards your professional goals in Robotic Process Automation (RPA)

Don't hesitate to talk with our course advisor right now

Receive a call

Contact NowMake a call

+1-732-338-7323Take our FREE Skill Assessment Test to discover your strengths and earn a certificate upon completion.

Enroll for the next batch

rpa certification online

- Dec 12 2025

- Online

rpa certification online

- Dec 15 2025

- Online

rpa certification online

- Dec 16 2025

- Online

rpa certification online

- Dec 17 2025

- Online

rpa certification online

- Dec 18 2025

- Online

Related blogs on Robotic Process Automation (RPA) to learn more

Who can Learn Robotic Process Automation?

Master Robotic Process Automation (RPA) and transform your career with our comprehensive courses, designed for anyone looking to improve their chances of getting job in the near future.

5 Leading Robotic Process Automation Tools

5 leading tools offer advanced features such as AI, machine learning, and low-code development to streamline workflows, reduce errors, and increase efficiency.

What is RPA certification

Robotic Process Automation (RPA) has emerged as a transformative force in the realm of business process automation, and the demand for RPA certification is on the rise. Let's delve into the factors that make RPA certification highly sought after in t

Which RPA Certification is in High Demand

RPA (Robotic Process Automation) certification is in high demand primarily due to the widespread adoption of automation technologies across industries. As businesses seek to enhance operational efficiency, reduce costs, and improve productivity, RPA

RPA Tools and Technologies: Choosing the Right Platform for Your Business

RPA Tools and Technologies: Choosing the Right Platform for Your Business

RPA Implementation and Deployment: Best Practices for Successful Automation Projects

Introduction The deployment of

Learn all about RPA Robotic Process Automation Tools and Technology

What is robotic process automation?

Latest blogs on technology to explore

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Explore the growing field of prompt engineering, a vital skill for AI enthusiasts. Learn how to craft optimized prompts for tools like ChatGPT and Gemini, and discover the career opportunities and skills needed to succeed in this fast-evolving indust

How Security Classification Guides Strengthen Data Protection in Modern Cybersecurity

A Security Classification Guide (SCG) defines data protection standards, ensuring sensitive information is handled securely across all levels. By outlining confidentiality, access controls, and declassification procedures, SCGs strengthen cybersecuri

Artificial Intelligence – A Growing Field of Study for Modern Learners

Artificial Intelligence is becoming a top study choice due to high job demand and future scope. This blog explains key subjects, career opportunities, and a simple AI study roadmap to help beginners start learning and build a strong career in the AI

Java in 2026: Why This ‘Old’ Language Is Still Your Golden Ticket to a Tech Career (And Where to Learn It!

Think Java is old news? Think again! 90% of Fortune 500 companies (yes, including Google, Amazon, and Netflix) run on Java (Oracle, 2025). From Android apps to banking systems, Java is the backbone of tech—and Sulekha IT Services is your fast track t

From Student to AI Pro: What Does Prompt Engineering Entail and How Do You Start?

Learn what prompt engineering is, why it matters, and how students and professionals can start mastering AI tools like ChatGPT, Gemini, and Copilot.

Cyber Security in 2025: The Golden Ticket to a Future-Proof Career

Cyber security jobs are growing 35% faster than any other tech field (U.S. Bureau of Labor Statistics, 2024)—and the average salary is $100,000+ per year! In a world where data breaches cost businesses $4.45 million on average (IBM, 2024), cyber secu

SAP SD in 2025: Your Ticket to a High-Flying IT Career

In the fast-paced world of IT and enterprise software, SAP SD (Sales and Distribution) is the secret sauce that keeps businesses running smoothly. Whether it’s managing customer orders, pricing, shipping, or billing, SAP SD is the backbone of sales o

SAP FICO in 2025: Salary, Jobs & How to Get Certified

AP FICO professionals earn $90,000–$130,000/year in the USA and Canada—and demand is skyrocketing! If you’re eyeing a future-proof IT career, SAP FICO (Financial Accounting & Controlling) is your golden ticket. But where do you start? Sulekha IT Serv

Train Like an AI Engineer: The Smartest Career Move You’ll Make This Year!

Why AI Engineering Is the Hottest Skillset Right Now From self-driving cars to chatbots that sound eerily human, Artificial Intelligence is no longer science fiction — it’s the backbone of modern tech. And guess what? Companies across the USA and Can

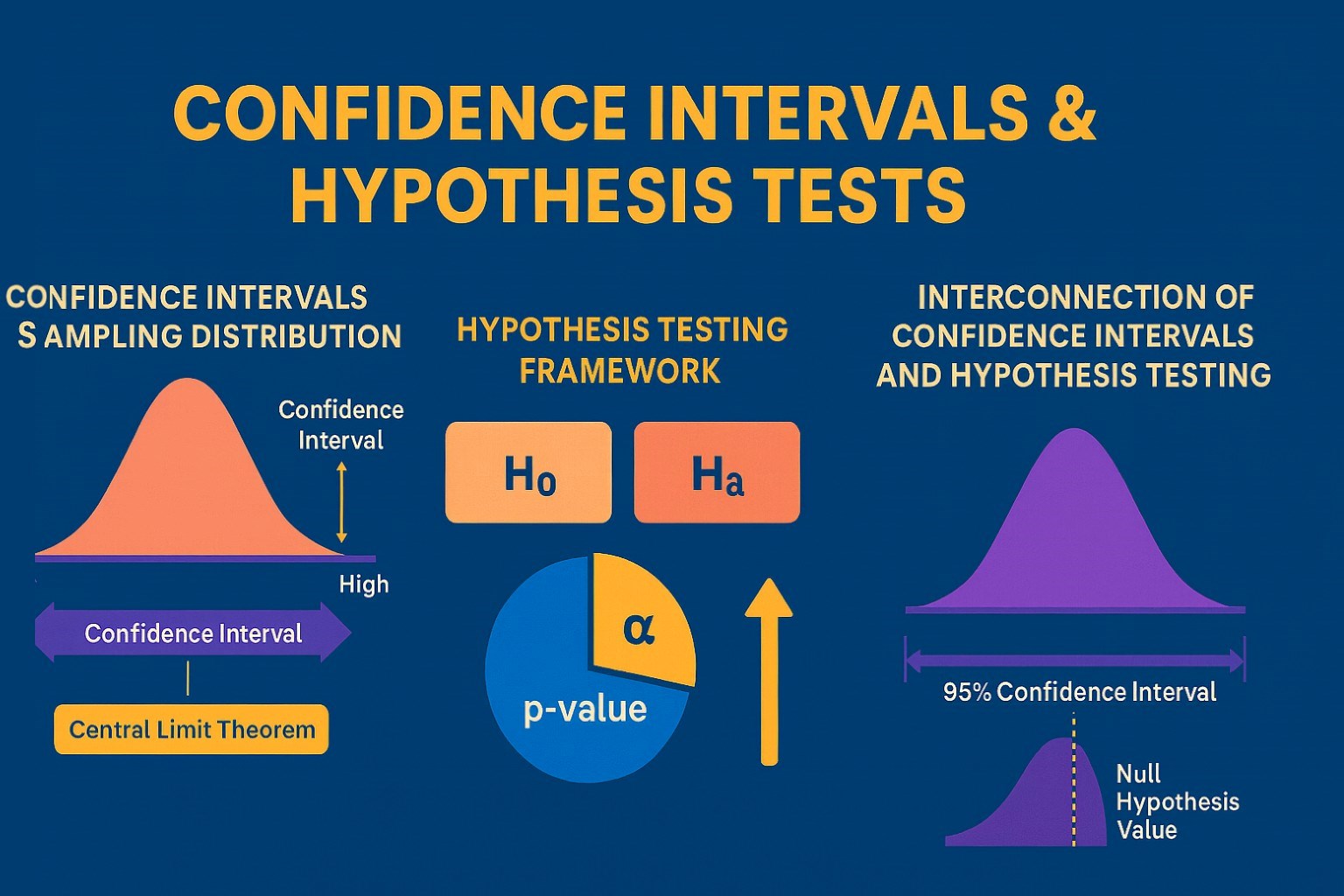

Confidence Intervals & Hypothesis Tests: The Data Science Path to Generalization

Learn how confidence intervals and hypothesis tests turn sample data into reliable population insights in data science. Understand CLT, p-values, and significance to generalize results, quantify uncertainty, and make evidence-based decisions.